惠誉:船舶减排将压缩船企利润空间

作者: 发布时间:2021年05月06日 浏览量:1044 字体大小: A+ A-

图片来自网络,版权属于原作者

来源:Hellenic Shipping News 2021-05-05

翻译:国际海事信息网 黄子倩 张运鸿

惠誉国际评级(Fitch Ratings)表示,尽管速度较慢,但全球航运业的排放监管将不断收紧,因此针对使用替代燃料的新型船舶的投资需求在增加,运营成本也在不断提高。这将给竞争激烈、变化无常的航运企业带来额外的利润和现金流压力。

2018年4月,联合国下属航运业监管机构——国际海事组织(International Maritime Organization, IMO)制定了船舶温室气体减排初步计划,预计到2050年减排50%以上,到2030年碳排放强度(carbon intensity)下降40%以上,2050年下降70%(与2008年数据相比)。虽然该减排计划对航运业尚无法律约束力,但惠誉表示仍期望2030年能够有更加具体、约束力更强的法规出台。鉴于船舶的实用经济寿命(useful economic life)只有20-30年,2050年的目标只有一个船舶生命周期。

由于航运业的资产寿命较长,对能源的依赖度高,可供选择的交通工具有限,因此其与空运、陆运一样,脱碳难度大。由于行业利润率通常较低,投资回收期较长,因此航运企业往往不愿大举投资,尤其是针对未经验证的新技术进行投资。目前的替代燃料有氢能和氨能,可作为高碳燃料(carbon-intensive fuels)的替代品,而液化天然气(LNG)则被认为是一种可能的过渡燃料。

许多利益相关方呼吁制定全球协调性的航运脱碳方案,但障碍重重。虽然有一系列的替代燃料可供选择,但这些燃料均不能大规模推广。此外,大量的船舶设计商和建造商给行业协调发展增加了难度,而不同类型的船舶(包括油船、集装箱船和散货船)在环保燃料的选择上有不同的经济考量和偏好。燃料基础设施的可用性也是一个需要全球协调的挑战。

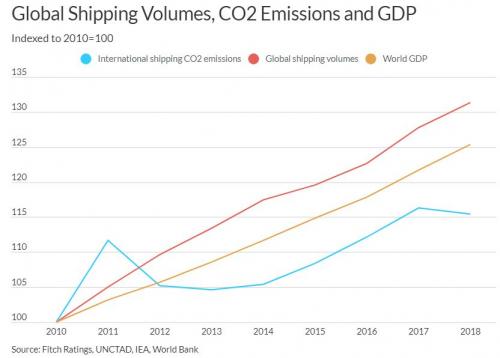

海运过程对终端客户(end-customers)来说并不直观。因此,尽管航运业在全球经济中作用突出,但直到目前为止,与航空或陆路运输相比,航运业在环境影响上受公众监督的程度还较低。海运占全球贸易总量的80%,占全球温室气体排放量的3%。据推算,如果不采取新的减排规定,到2050年,这一排放比例将超过10%。大部分航运企业杠杆率高,利润率低。因此,脱碳一直不是航运业的第一优选。

根据预测,航运业内的监管将逐步收紧,促使业内转变脱碳战略,最终,技术的发展可带来经济上可行的替代燃料。不过,能源转型很可能会增加航运公司利润和现金流上的压力。企业需要增加资本支出,以购买使用替代燃料的新型船舶。此外,在应用新技术的早期阶段,特别是在全球范围内替代燃料紧缺的情况下,企业很可能需要承担更高的燃料费用,导致作业效率低下。

在航运领域,环保政策还可能引入碳交易(carbon-trading)或碳抵消(carbon-offsetting)机制,类似于欧盟碳排放权交易体系(EU Emissions Trading System)或国际航空碳抵消和减排计划(Carbon Offsetting and Reduction Scheme for International Aviation),这将增加船公司的成本。据预计,该行业的竞争仍会十分激烈,船公司将增加的成本转嫁给客户的空间很小。不过,这些变化将发生在惠誉的评级范围之外。

(本文版权归国际海事信息网所有,图片版权归原作者,转载请注明出处。)

Shipping Emission Rules to Gradually Tighten, Weakening Profits

Global shipping emission regulations are set to tighten, albeit slowly, requiring investment in new vessels powered by alternative fuels and increasing operating costs, Fitch Ratings says. This will put additional pressure on the profits and cash flows of companies in the competitive and volatile industry.

In April 2018, the International Maritime Organization (IMO), a UN agency responsible for regulating the shipping industry, set out its initial strategy to reduce ships’ greenhouse gases (GHG) emissions by at least 50% by 2050, while reducing their carbon intensity by at least 40% by 2030 and 70% by 2050 (compared to 2008 levels). While this decarbonisation plan is not yet legally binding for shippers, we expect more specific and mandatory regulations before 2030. Given that vessels have a useful economic life of 20-30 years, the target year of 2050 is only one ship lifetime away.

Shipping – along with airlines and road freight – is a difficult sector to decarbonise due to its long asset lifespans, high energy dependency and limited viable transportation alternatives. Shippers are reluctant to commit to heavy investments, especially into unproven technologies, as sector margins are typically low, leading to long payback periods. Several alternatives, such as hydrogen and ammonia, are being considered as a replacement for carbon-intensive fuels, while liquefied natural gas (LNG) is viewed as a likely transition fuel.

Many stakeholders call for a coordinated global approach to shipping decarbonisation, which could face a number of hurdles. Although a range of alternative fuel options is available, none of these options are yet viable at scale. Furthermore, the large number of ship designers and builders make harmonised developments difficult, while various types of vessels (including tankers, container ships and bulkers) have different economics and preferences for greener options. The availability of fuelling infrastructure is another challenge that requires global coordination.

Shipping is less visible to end-customers. Therefore, until recently, its environmental impact has been less exposed to public scrutiny, compared to airlines or land transportation, despite its prominent role in the global economy. Shipping transports 80% of global trade volumes and is responsible for 3% of global GHG emissions, which we estimate could grow to over 10% by 2050 if no new regulation to cut emissions is adopted. Shipping companies usually have high leverage and operate with low margins. For these reasons, decarbonisation has been a secondary priority for the industry.

We expect tighter regulations to prompt a shift in the sector’s decarbonisation strategies, while technological developments will eventually deliver economically viable fuel alternatives. However, the energy transition is likely to add to pressures on shippers’ profits and cash flows. They will need to increase capex to buy new vessels powered by alternative fuels. Furthermore, shippers are likely to incur higher fuel costs during the early stages of adopting new technologies, especially if alternative fuels are not readily available globally, leading to operational inefficiency.

Expedited green policies may also introduce a carbon-trading or -offsetting mechanism in shipping, similar to the EU Emissions Trading System or the Carbon Offsetting and Reduction Scheme for International Aviation, increasing costs for vessel operators. We expect competition in the industry to remain fierce, leaving little room for shippers to pass through increased costs to customers. However, we anticipate that these changes will take place outside of our rating horizon.

来源:simic

今日要闻

图片新闻

海外传真

热点报道